Financial Aid

Navigating the financial aid process can be challenging at times. Don’t worry. We’re ready to lead the way. Our team is here to help you take advantage of all the available resources so that you can maximize aid and minimize your long-term investment.

Contact

- Financial Aid Office

- Davie Jane Gilmour Center, Rm. 1013

570.327.4766 800.367.9222 - finaid@pct.edu

Applying for Aid

Stay on top of the financial aid process. Learn which forms to submit and when to send them.

Estimate Cost

See expected costs for your intended program of study, residency status, on-campus housing, and dining plan options using our helpful tool.

Aid Notification

Naturally, you want to know how much aid you are getting. The process of awarding aid is ongoing, but there are a few guidelines to keep in mind.

Questions

Have you completed your FAFSA?

It’s fast. It’s easy. And it’s required to access any federal aid.

Head over to the U.S. Department of Education’s site to get started.

FAFSA Priority Deadline for 2026-27: March 1 School Code: 003395

Put your financial aid plan into action

Explore your options and learn about important deadlines.

Grants

Provided you are eligible, grants are a preferred way to pay for college expenses. Grants are based on financial need and do not need to be paid back. Completing a FAFSA is the only application required for federal grants.

Scholarships

Another preferred aid option, scholarships are an excellent way to cover costs and do not need to be paid back. Some scholarships can be renewed in future years. Others are specifically for one year or one semester. You must apply for scholarships.

Loans

Typically used to bridge the gap, loans help pay for expenses that other types of aid and resources do not cover. Unlike grants and scholarships, loans need to be repaid. Each type of loan has its own application process.

Work-Study

The Federal Work-Study Program allows you to work in offices across campus in a part-time position related to your major. Compensation is in the form of a paycheck, which can be used to cover educational expenses.

Other Aid Programs & Financial Options

Everyone’s financial picture is a little different. Research all options so that you can make the most informed plan.

Veterans & Military Aid

If you served in the military, are an active-duty member, or are a dependent or family member of a veteran, benefits may be available to you.

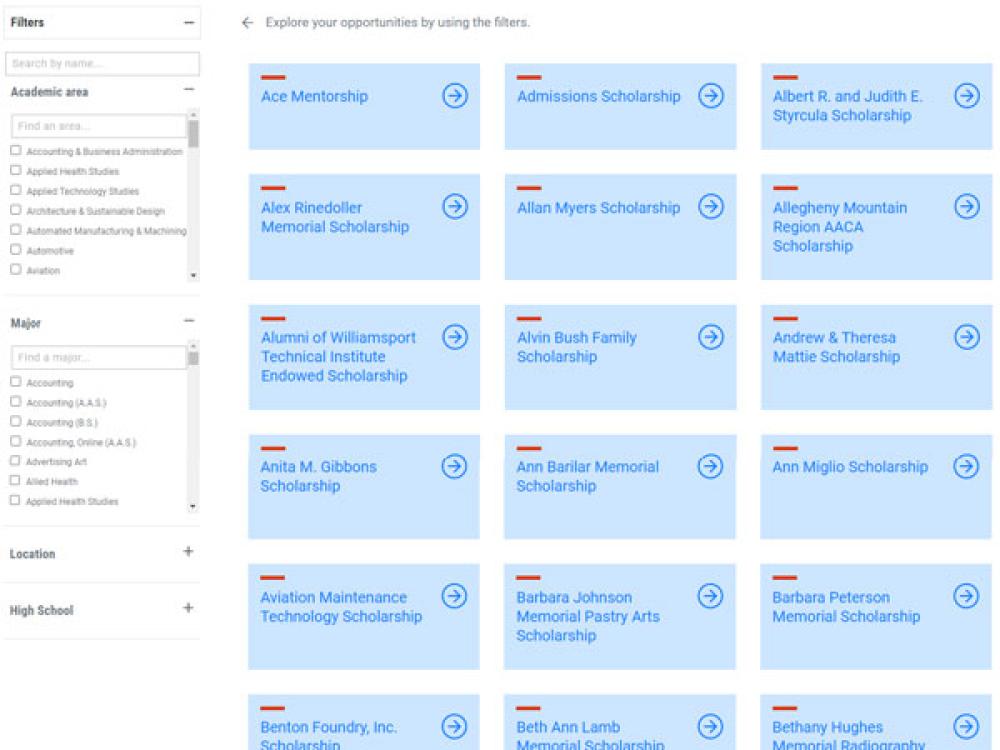

Penn College Scholarships

Submit one application and you’ll be considered for all eligible Penn College scholarships, 350+ and counting. Awarding begins April 1.

Tuition & Fees

Planning ahead for your bill? Smart thinking. In addition to tuition, you can expect to find several other fees on your bill. Here’s a preview of common charges.

$0

Application Fee

$623

In-State Tuition & Fees

(per credit hour)

$888

Out-of-State Tuition & Fees

(per credit hour)

Cost Estimator

In addition to tuition, each program has unique expenses like books and tools. Use the estimator to plan your anticipated costs.

Return on Investment

The Value of a Penn College Education

When you invest in a college education, you want to know that your hard work will pay off. At Penn College, it will.

Payment Plans

Students can split their semester bill into five installments. Just pay a $30 enrollment fee plus 20% down on tuition, housing, and related fees and you’re in. Optional charges like meal plans and parking permits can’t be rolled into the plan. Interested? You can enroll when your course load is determined and your bill is generated. Reach out to the Bursar's Office at 570.327.4762 or via email to learn more.