Bob Nolan

- Faculty

- Accounting & Business Administration

Thinking about a career in accounting? Meet Bob Nolan, an instructor at Penn College. He brings a wide range of industry experience to the classroom. From financial reporting and tax preparation to compliance issues, Bob shares his experiences with the next generation of accounting professionals.

Q&A with Bob

WHAT SPARKED YOUR INTEREST IN ACCOUNTING?

I initially took a few accounting courses in high school, which was really the main driver that sparked my interest in accounting. While many people think accounting is all about math, it really only requires fairly basic math and is more about organizing numbers and following the rules set forth by the different authoritative bodies, such as the Generally Accepted Accounting Principles (GAAP), Generally Accepted Auditing Standards (GAAS), and the Internal Revenue Code (IRC). Beyond these areas of accounting, accounting can get far more interesting when looking into more advanced areas like forensic accounting.

WHAT DO YOU ENJOY MOST ABOUT TEACHING AT PENN COLLEGE?

Every part of teaching here has been thoroughly enjoyable to me. I do like the wide range of students I get to see in the introductory accounting course. Seeing our Accounting program students along their entire journey within the program is also extremely rewarding for me. Beyond this, I like how we are encouraged to actively seek out ways to provide hands-on accounting experiences for our students. It is also great seeing and hearing about student success in the workforce after graduation. There is nothing more rewarding than hearing from employers how well our graduates are doing with them.

HOW DOES YOUR INDUSTRY EXPERIENCE PLAY A ROLE IN YOUR TEACHING?

I would say my teaching would not be nearly as effective without my industry experience. I was lucky enough to have a number of years working in both private and public accounting before teaching where I can now provide insight to students about not only the key differences between the two but also specifics about what the day-to-day work entails. This wide range of experience from a general ledger/financial reporting standpoint to tax preparation and compliance issues has really come in handy in the classroom.

WHY SHOULD A STUDENT CONSIDER PENN COLLEGE FOR ACCOUNTING?

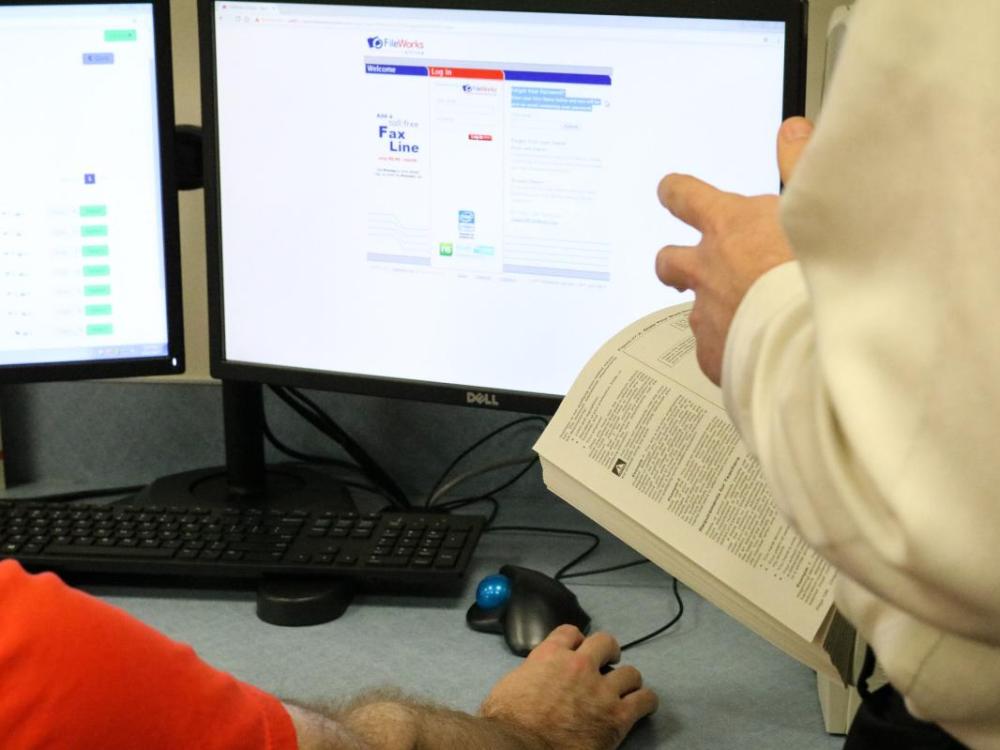

Offering students hands-on experience is something that sets us apart from most other accounting programs. Providing a real-world type of experience in a few of our accounting classes does provide our students with an edge as they move on into the profession after graduating. Our unique blend of classroom learning, coinciding with the use of the current technologies and real-world experiences within the classroom sets us apart.

TELL US ABOUT SOMETHING FASCINATING YOU TEACH?

One of the more fascinating areas of accounting is forensic accounting. Just like the name describes, this is taking an investigatory approach to an individual’s or company’s financial information to help detect things like fraud or loss of wages or business income due to damages suffered. Beyond this, the class also talks about some of the legal aspects of forensic accounting engagement such as evidence handling and the judicial process.

IS THERE ANYTHING ELSE THAT MAKES THE ACCOUNTING PROGRAM AT PENN COLLEGE UNIQUE?

Another fascinating component of our accounting program is our Individual Taxation class, which provides students with real-world hands-on experience. We spend the first few weeks of class getting all the students certified by the IRS to prepare tax returns as a volunteer, then spend tax season (early February through mid-April) preparing tax returns free of charge to students, staff, and local community members. Not only does this class help students gain knowledge and experience with our own mini ‘tax season’, but it also encourages the growth of those soft skills as they meet with taxpayers and go over their tax returns with them. This is an area that many employers say recent graduates typically are underdeveloped in and something our unique hands-on classroom experience helps to provide to our students.

Featured Video

Your Class in 60 Seconds

Income Taxation for Individuals

Pursue an Accounting degree at Penn College and you'll take ACC332 Income Taxation for Individuals. In this class, you'll learn tax prep skills and put them to work helping community members submit tax returns through the VITA (Volunteer Income Tax Assistance) program--a government-sponsored initiative.

Guaranteed Momentum

Leading the way

Read more about the students who provided Volunteer Income Tax Assistance to the community under the leadership of Bob Nolan. The students in accounting and business administration majors provided free help with income tax returns for 98 individuals in the local community through an IRS program on campus.

Programs

Accounting & Business Administration

Navigate the field of accounting and diverse world of business.

All Programs

Unsure which major is right for you? See all academic programs at-a-glance.