Penn College students provide Volunteer Income Tax Assistance

Friday, April 28, 2023

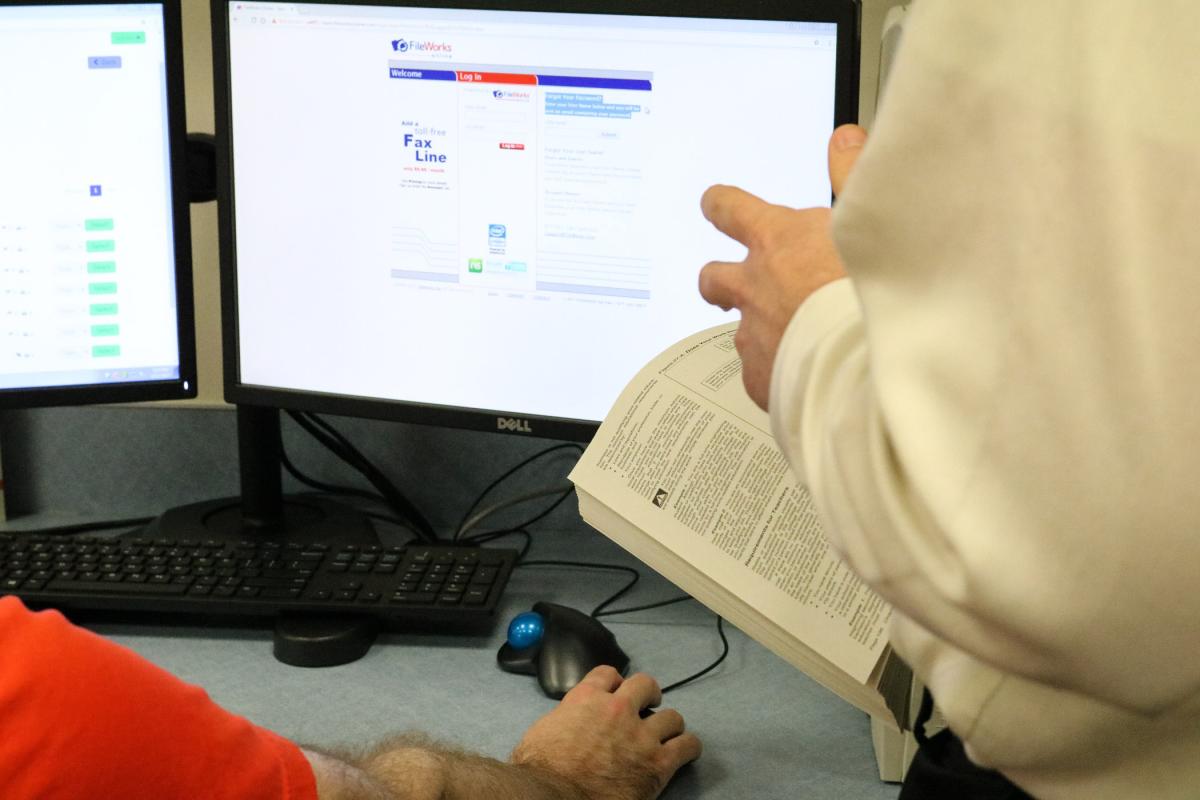

Through an on-campus Volunteer Income Tax Assistance site, students in Pennsylvania College of Technology’s accounting major and business administration: banking & finance major helped members of the Greater Williamsport community to file 98 2022 income tax returns, with a total of $103,562 in federal tax refunds and $4,597 in state tax refunds.

Pennsylvania College of Technology students in accounting and business administration majors recently provided free help with income tax returns for 98 individuals in the local community through an IRS Volunteer Income Tax Assistance site on campus.

VITA is an IRS program that offers free basic tax return preparation to qualified individuals. Students who help at the VITA site receive IRS training and certification at the beginning of the spring semester. The college’s VITA site was open Feb. 6 to April 11.

Six students provided the assistance, under the leadership of Robert M. Nolan, instructor of business administration/accounting and finance and a certified public accountant. Previous VITA student Shawn Twigg volunteered to help with the program this year, as well.Twigg earned a bachelor’s in business administration: banking & finance in 2020 and is a financial adviser with The Comprehensive Financial Group in Williamsport.

Nolan applauded Twigg’s willingness to step in and help.

“He expressed interest in helping with the program after he participated as a student three years ago,” Nolan said. “He helped with various aspects of the program, from helping to answer student questions, to reviewing tax returns and helping students go over the tax returns with the taxpayers once they were completed.”

“His volunteering to assist us was crucial in the program running so smoothly this year,” Nolan added. “Even though we had more limited hours this year than we did in years past, we were still able to prepare just under 100 tax returns for local community members, a service that is greatly appreciated by those who are able to set up an appointment.”

“All of his time and assistance was greatly appreciated,” Nolan said.

Penn College offers an associate degree and a bachelor’s degree in accounting, as well as a bachelor’s degree in business administration with a specialization in banking & finance. All three options are available both on campus and online. To learn more, call 570-327-4505.

For more about Penn College, a national leader in applied technology education, email the Admissions Office or call toll-free at 800-367-9222.