Treasurer Garrity, Sen. Yaw visit to promote PA 529 savings program

Thursday, June 2, 2022

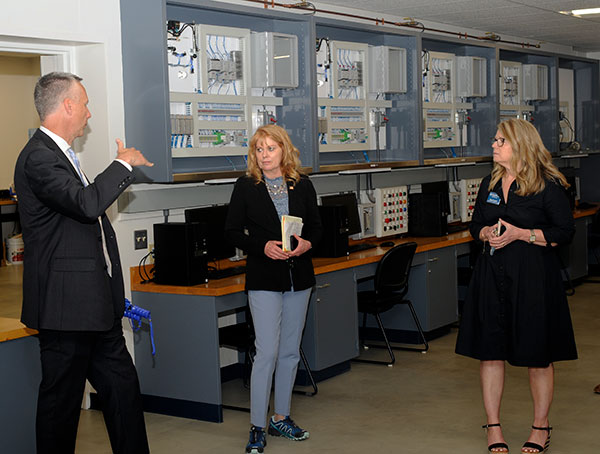

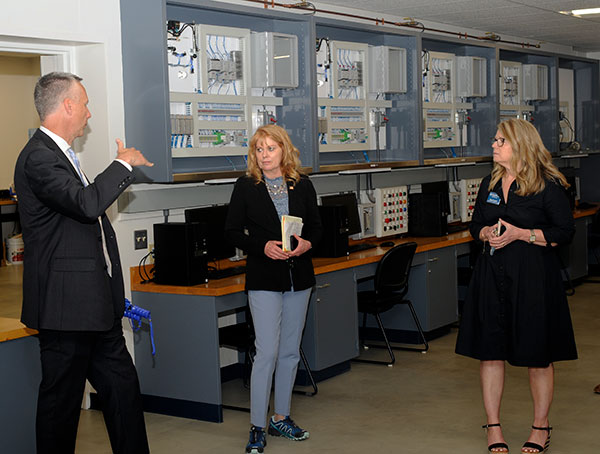

Pennsylvania Treasurer Stacy Garrity joined state Sen. Gene Yaw (R-23) on a Thursday tour of Pennsylvania College of Technology, hosted by President Davie Jane Gilmour, to promote the PA 529 College and Career Savings Program.

“Penn College offers a wide range of programs that are crucial to making sure Pennsylvania has the highly skilled workers we need for the future,” Garrity said. “Treasury’s PA 529 plans are the perfect tool to help families save and pay for education – including the popular nursing, welding and information technology programs here at Penn College. I want to thank Sen. Yaw and Dr. Gilmour for inviting me to tour this impressive campus.”

“I’m very pleased that Treasurer Garrity accepted my invitation to visit Penn College as part of her commitment to tour technical institutions in Pennsylvania,” said Yaw, who also chairs the college's Board of Directors. “We were excited to welcome her to the campus and show off why it appeals to so many students. In addition, we encourage all prospective students and their families to consider using a PA 529 account to invest in their future success by enrolling in one of the campus’s premier technical programs.”

“I’m very pleased that Treasurer Garrity accepted my invitation to visit Penn College as part of her commitment to tour technical institutions in Pennsylvania,” said Yaw, who also chairs the college's Board of Directors. “We were excited to welcome her to the campus and show off why it appeals to so many students. In addition, we encourage all prospective students and their families to consider using a PA 529 account to invest in their future success by enrolling in one of the campus’s premier technical programs.”

“We were delighted to have Treasurer Garrity with us today to tour campus and see firsthand the types of hands-on academic programs that we offer. Penn College degrees continue to address a variety of crucial workforce needs throughout the commonwealth,” Gilmour said. “Many of our students need scholarship and financial aid assistance to complete their education, and PA 529 plans are another tool to help students and families meet the costs of college.”

“We were delighted to have Treasurer Garrity with us today to tour campus and see firsthand the types of hands-on academic programs that we offer. Penn College degrees continue to address a variety of crucial workforce needs throughout the commonwealth,” Gilmour said. “Many of our students need scholarship and financial aid assistance to complete their education, and PA 529 plans are another tool to help students and families meet the costs of college.”

The tour included visits to the Student & Administrative Services Center, Veterans & Military Resource Center, Carl Building Technologies Center, Electrical Technologies Center, Lycoming Engines Metal Trades Center, and College Avenue Labs, and concluded with a lunch at Le Jeune Chef, an on-campus restaurant within Penn College's School of Business, Arts & Sciences.

The college has been in operation for more than 100 years, and offers approximately 100 areas of study from certificates to associate, bachelor’s and master’s degrees.

The college has been in operation for more than 100 years, and offers approximately 100 areas of study from certificates to associate, bachelor’s and master’s degrees.

PA 529 accounts have been helping Pennsylvania families steadily and strategically save for future educational expenses for more than 30 years. Treasury offers two plans: the PA 529 Guaranteed Savings Plan, which allows families to save at today’s tuition rates to meet tomorrow’s tuition costs, and the Morningstar Silver Rated PA 529 Investment Plan that offers a number of investment options.

PA 529 plans have significant state and federal tax advantages and can be used for a wide variety of qualified technical, collegiate, apprenticeship and K-12 educational expenses.

PA 529 plans have significant state and federal tax advantages and can be used for a wide variety of qualified technical, collegiate, apprenticeship and K-12 educational expenses.

To learn more about PA 529 accounts and to start saving, visit pa529.com, email the Pennsylvania Treasury or call 800-440-4000.

“Penn College offers a wide range of programs that are crucial to making sure Pennsylvania has the highly skilled workers we need for the future,” Garrity said. “Treasury’s PA 529 plans are the perfect tool to help families save and pay for education – including the popular nursing, welding and information technology programs here at Penn College. I want to thank Sen. Yaw and Dr. Gilmour for inviting me to tour this impressive campus.”

“I’m very pleased that Treasurer Garrity accepted my invitation to visit Penn College as part of her commitment to tour technical institutions in Pennsylvania,” said Yaw, who also chairs the college's Board of Directors. “We were excited to welcome her to the campus and show off why it appeals to so many students. In addition, we encourage all prospective students and their families to consider using a PA 529 account to invest in their future success by enrolling in one of the campus’s premier technical programs.”

“I’m very pleased that Treasurer Garrity accepted my invitation to visit Penn College as part of her commitment to tour technical institutions in Pennsylvania,” said Yaw, who also chairs the college's Board of Directors. “We were excited to welcome her to the campus and show off why it appeals to so many students. In addition, we encourage all prospective students and their families to consider using a PA 529 account to invest in their future success by enrolling in one of the campus’s premier technical programs.” “We were delighted to have Treasurer Garrity with us today to tour campus and see firsthand the types of hands-on academic programs that we offer. Penn College degrees continue to address a variety of crucial workforce needs throughout the commonwealth,” Gilmour said. “Many of our students need scholarship and financial aid assistance to complete their education, and PA 529 plans are another tool to help students and families meet the costs of college.”

“We were delighted to have Treasurer Garrity with us today to tour campus and see firsthand the types of hands-on academic programs that we offer. Penn College degrees continue to address a variety of crucial workforce needs throughout the commonwealth,” Gilmour said. “Many of our students need scholarship and financial aid assistance to complete their education, and PA 529 plans are another tool to help students and families meet the costs of college.”The tour included visits to the Student & Administrative Services Center, Veterans & Military Resource Center, Carl Building Technologies Center, Electrical Technologies Center, Lycoming Engines Metal Trades Center, and College Avenue Labs, and concluded with a lunch at Le Jeune Chef, an on-campus restaurant within Penn College's School of Business, Arts & Sciences.

The college has been in operation for more than 100 years, and offers approximately 100 areas of study from certificates to associate, bachelor’s and master’s degrees.

The college has been in operation for more than 100 years, and offers approximately 100 areas of study from certificates to associate, bachelor’s and master’s degrees.PA 529 accounts have been helping Pennsylvania families steadily and strategically save for future educational expenses for more than 30 years. Treasury offers two plans: the PA 529 Guaranteed Savings Plan, which allows families to save at today’s tuition rates to meet tomorrow’s tuition costs, and the Morningstar Silver Rated PA 529 Investment Plan that offers a number of investment options.

PA 529 plans have significant state and federal tax advantages and can be used for a wide variety of qualified technical, collegiate, apprenticeship and K-12 educational expenses.

PA 529 plans have significant state and federal tax advantages and can be used for a wide variety of qualified technical, collegiate, apprenticeship and K-12 educational expenses.To learn more about PA 529 accounts and to start saving, visit pa529.com, email the Pennsylvania Treasury or call 800-440-4000.